Did you know that you could be making money from your spare change? Instead of just leaving it sitting around doing nothing – like most people do – why not use micro-investing and invest it in diversified portfolio of stocks and bonds.

Did you know that you could be making money from your spare change? Instead of just leaving it sitting around doing nothing – like most people do – why not use micro-investing and invest it in diversified portfolio of stocks and bonds.

I've been using Acorns for the past couple of years and it really does work. I'm going to share with you how much money I've made using Acorns and how you too can do the same thing.

Making money from your spare change

Acorns is a micro-investing app. It's transfers small amounts of money from your transaction account into an acorns investment account. These small amounts are known as round-ups. Every time you make a purchase, Acorns will round that up to the nearest dollar and transfer the difference to Acorns. These small amounts don't seem like much at the time, but they really do add up. You can turn off round-ups or choose to round-up less. I'm going to explain why later on in this post why you shouldn't turn this automated investing features off.

Why Acorns is better than a savings account

Acorns invests your money in a diversified portfolio made up of ETFs. These ETFs contain thousands of underlying assets including bonds and stocks. This means your $1 investment is invested across a huge range of diverse assets! That's pretty amazing.

So why is this better than a savings account? Well a savings account is great for an emergency fund and having quick access to cash. But it's really bad for actually saving! That's because of inflation. Every year, thanks to inflation, your money is worth a little bit less. The inflation rate varies but is around 1-3%. So if your bank is only paying you 0.02% interest or whatever other joke interest rate they offer, you are actually losing money the longer you keep it in a savings account.

That's why you need to invest. You're not going to get anywhere just by putting money aside. Simple maths tells you that it just won't work in the long run!

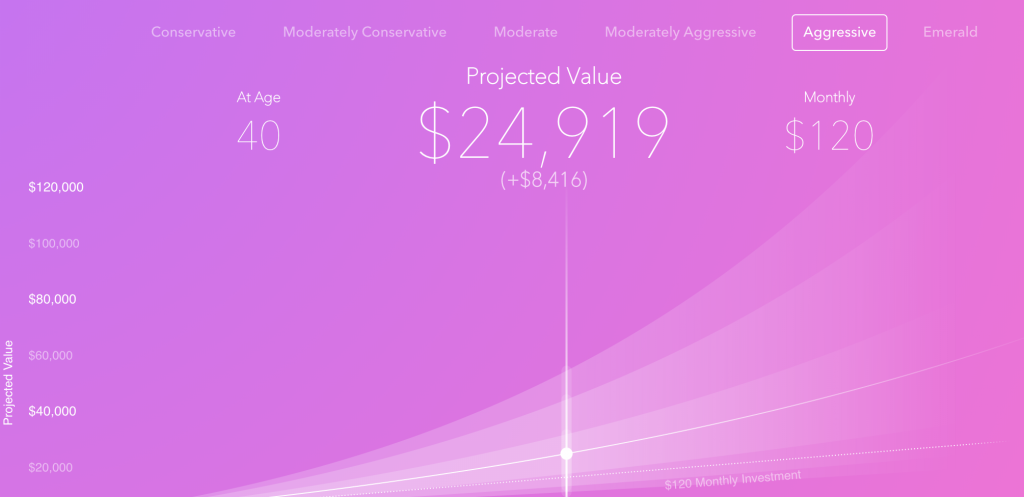

The Acorns portfolios (there are 6 you can choose from) are not only designed to beat inflation, but also grow your capital over time. The longer you use Acorns, the faster you'll accumulate wealth.

Why You Need Automated Investing

A lot of people are hesitant about automated investing. And those people are probably living paycheck to paycheck and just treading water. One of the biggest hurdles of investing in the psychological barrier. For some strange reason, people like to keep excess money in their spending account and don't want to transfer money into an investment account. This doesn't make any sense, so I can't explain it. But just know that people who invest absolutely every cent they possibly can, are the ones who don't struggle in the longer term.

Acorns helps you get over the psychological barriers of investing. Don't turn off round-ups in the app, and setup a recurring weekly deposit as well – even if it's just a few dollars. The more regularly you contribute to Acorns the more you'll benefit from the compounding effect.

How much can you make from Acorns?

I've used Acorns for the past 2 years. I've invested my spare change through round-ups. This isn't my main investing account – I invest in a number of different things. But i've managed to make a gain of over 16% which is around $255 in my account. That is $255 in extra money. There is NO WAY you'd be able to make that with around $3k of capital in a savings account. And I doubt you'd be able to make that much investing on your own in stocks or bonds with $3k. And all those dividend investors – there is no way they would have made that much from dividend stocks. So yes, you really can make money with Acorns. Acorns is a legit way to turn your money into more money.

Note – When I wrote this post, the market had just suffered massive losses. It's a testament to how well Acorns was put together that I am still in the profit. My return before the market downturn was over 28%.

How to Get Started on Acorns

- Download the App Here

- Link the app with your bank account

- Choose a portfolio to invest in. Acorns will recommend the one that suits your age.

- Sit back and do nothing

Just let acorns run for a bit in the background. Acorns is a longer term investing strategy. Although you can pull your money out at anytime – or withdraw small amounts if you wish, you'll benefit from compounding if you keep growing your nest egg.