Getting started investing can seem very daunting. But everyone has to start somewhere. In this post I'm going to show you how you can start investing with as little as $5. And also break down the difference between saving vs investing and why you should be combining the two to really grow your net worth.

Getting started investing can seem very daunting. But everyone has to start somewhere. In this post I'm going to show you how you can start investing with as little as $5. And also break down the difference between saving vs investing and why you should be combining the two to really grow your net worth.

Don't just save for the sake of saving

One of the most common, yet wrong, pieces of financial advice people give is you should be putting money aside in a savings bank account. But it takes some super basic maths to realise that this strategy is foolish. Why? Inflation!

Each year, your money is worth less and less. That's inflation. It's the reason why your grandparents were able to buy a house for $20k and a loaf of bread for cents rather than dollars. The inflation rate varies from year to year, but one thing you can be sure of – if you put money aside now, in 20 years its going to have much less buying power than it does now.

A savings account might offer you interest on your savings, but this is less than the inflation rate. Unless they are giving you more than 3% interest (which no bank does), you're losing out to inflation.

So just save for the sake of saving. It doesn't work! That's why you need a smarter plan and i'm going to share with you what I think a great plan is below.

Keeping an Emergency Fund

Just because a savings account isn't a smart way to grow your net worth, it doesn't mean they are useless. I keep a certain amount of cash in an “emergency fund”. This is just a savings account where I keep enough money to cover things like rent, bills and health expenses. You never know what's around the corner. I'm a full-time blogger/trader. Which is really unpredictable so it makes sense to keep some cash in a savings account which will be liquid and easily accessible when needed.

Saving for Big Expenses

Another good use for a savings account is saving towards a larger expense. For example I used to savings account for an upcoming holiday. This was a big expense ($10k+) so I started saving a while back in anticipation.

It's also good to save for things like household appliances, nice clothes etc. This way you'll be less tempted to put them on credit and only but them when you're in a position too.

A Better alternative to a savings account?

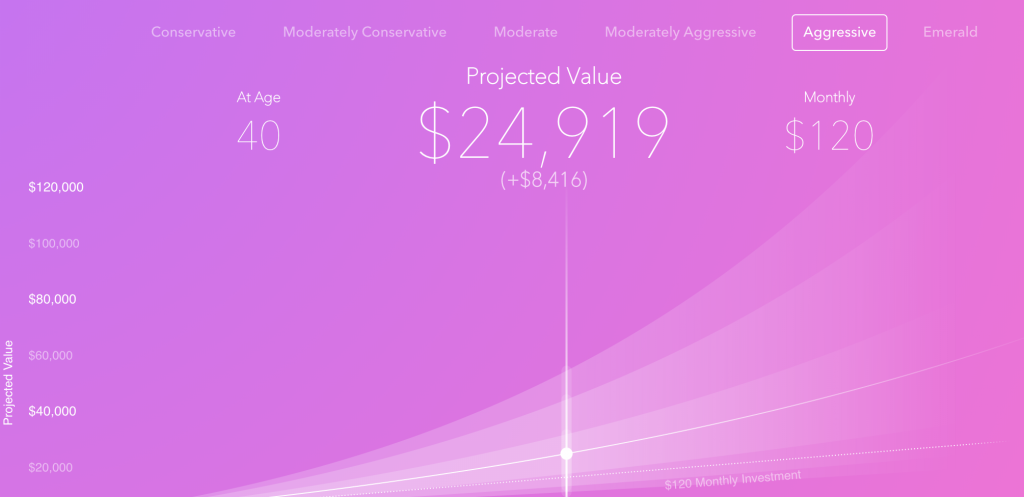

So where should you be saving? Well I think the best place is a diverse investment account with really low fees. And thankfully Acorns offers just that! I've been using Acorns for a while now and I'm a huge fan. It invests your small change in a diverse portfolio. You don't need to do anything. Just install the app, connect it to your bank and it does the rest.

You can test out Acorns for free here

Here is why you should be using something like acorns:

It beats Inflation

My return since I started investing is around 25%. This means that not only have I beaten inflation but I've made a handy profit. If I had put the same money in a savings account, it would now be worth less 🙁

You don't need to pick stocks

If you try picking stocks on your own, you'll probably fail. The majority of people do. It's not the 90's anymore where everybody got rich. The world is a different place. The Acorns portfolios have been put together with the help of Nobel Prize winning economist Dr. Harry Markowitz. So you can guarantee they are going to be better then whatever random strategy you think you have. Don't be that fool!

It's dollar cost averaging!

Dollar cost averaging is a proven way to invest. It involves investing small amount at regular intervals. This way sometimes you'll buy low and sometimes you'll buy high. Over time it averages out! Acorns will invest your spare change in small amounts that you don't even notice coming out of your account. And it does it continuously. Your investment will always keep growing.

It's Set and Forget

Most investments/savings plans fail because people get lazy or can't overcome the psychological barrier of putting money aside. Humans are odd! Acorns will work nicely in the background.

You can start saving/investing with $5

10 years ago, to invest in a diverse portfolio like Acorns, it would have required thousands of dollars of capital and you'd need to pay huge fees. Not anymore. Thanks to technology and the economy of scale, you can get started on Acorns with as little as $5.

As I said at the start of this post everyone needs to start somewhere – even if it's with just $5.

The sooner you start the better

One of the key effects of Acorns is compounding. You'll earn dividends and your investments will rise in value. This money is put back into the portfolio. So there is a compounding effect. The sooner you start the longer you'll have to benefit from compounding. Honestly I wish I had start way earlier.

How to pump more money into your investment

As well as investing my spare change I've setup Acorns so it deposits an extra lump sum each week. This is a great way to boost your investment. Here are some tips on how too can pump up your Acorns balance:

Cut down on your recurring expenses

Every few months I log into my bank account and make a list of my recurring expenses. By themselves, each expense doesn't seem like much, but they really do add up. When you add them all up, figure out which ones you really need. Figure out if you can maybe sign up to a cheaper plan or alternative. Then figure out how much you save buy cutting back and put this money into a recurring Acorns investment

Earn some income on the side

The best way to increase your net worth is to increase your income. Even a couple hundred extra dollars a month from something like Swagbucks could make a huge difference. I've put together a list of 18 different ways you could be making some extra money on the side.

Keep a Weekly Log of your Net Worth

I keep a spreadsheet with my net worth. I basically just add up all the liquid assets I have such as my bank accounts and Acorns etc. This gives me a great overview of how I've been spending each week and what my overall financial health is looking like.

Getting Started

Getting started is easy. Just download Acorns (it's free!) and give it a try. If you're in Australia you can use Raiz (which is basically Acorns but rebranded). I'll update this post with alternatives from other countries when I get the chance to try them out to make sure they're legit.