I've had a great experience investing with Acorns, so I thought I would share some tips on how you too can have success with Acorns. Acorns is an app that invests your spare change into a diversified investment portfolio.

I've had a great experience investing with Acorns, so I thought I would share some tips on how you too can have success with Acorns. Acorns is an app that invests your spare change into a diversified investment portfolio.

Top up your account to at least $100

Acorns charges a $1 monthly fee in the U.S and a $1.25 monthly fee in Australia. This is for accounts with less than $5k. After that they charge a %. Because of this fee, it doesn't make sense to have an acorns account with less than $100. Because the growth will be outweighed by the fees. So because of this I recommend trying to topup your account to at least $100. You can start investing for as little as $5 on Acorns. But you should aim to invest at least $100 to begin with.

The more you invest from this point on, the less impact the fees will have on your growth until you hit that $5k mark.

Recurring Payments

The investment strategy behind Acorns is dollar cost averaging. Basically investing small amounts at regular intervals over a long period of time. Acorns will automatically invest your spare change every time you make a purchase. If you want to get the most out of Acorns, I would recommend setting up a monthly payment as well.

Automated recurring payments are a great way to save and invest. You forget about them and they work in the background.

Choose a Portfolio to Match your Age

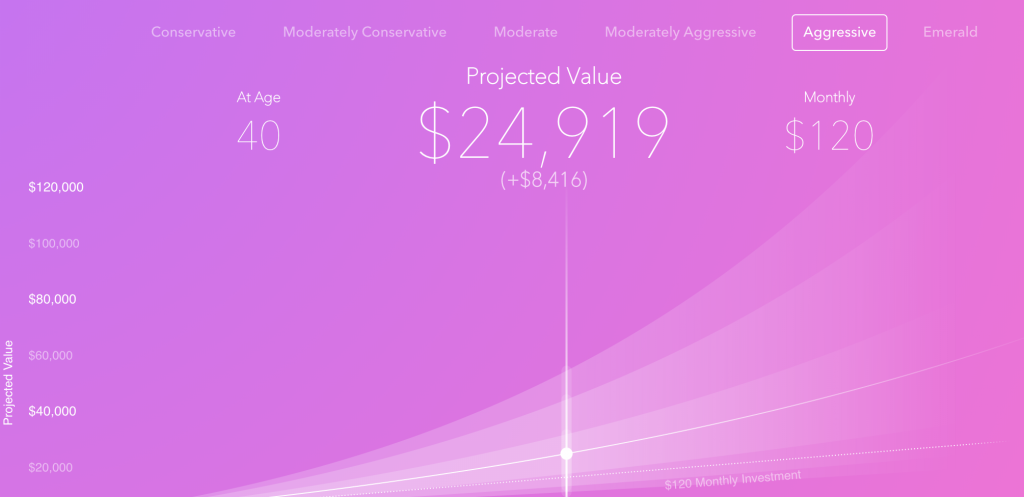

Acorns allows you to choose from 6 different portfolios. They range from conservative to aggressive as well as a sustainable portfolio called “Emerald” for those concerned about investing in socially responsible stocks.

It's important you choose a portfolio that matches your investment goals and age. If you're younger, you can afford a more aggressive portfolio. It will have the best chance of long term growth. If you're older and looking to maintain your capital, you'd choose a more conservative portfolio which is designed to keep pace with inflation but not lose value in the short term.

If you can afford it, go for growth 🙂

Don't Panic Sell

Acorns works by investing small amounts at regular intervals. Sometimes your money will be invested when the market is down. Sometimes when it is up. Overtime, this will average out. The worst thing you can possibly do is panic sell when the market goes down.

Markets do go down. They do occasionally crash. If you sell at this point you book a loss. If you hold steady though the markets will recover and things will carry on.

So you might see a loss from time to time. Just know that the fundamentals behind your investment are strong and have been put together by one of the best minds in finance. Just let Acorns do its job in the background. You won't lose all your money investing in Acorns. And on the flipside, you also won't get rich overnight. It's all about slow and steady investing.

So there you have it – my top tips for Acorns. Do you use Acorns or another similar app? Let me know how you find it in the comments.