Getting started in the world of stock trading can be exciting and also daunting. In this post I'm going to break down some of the options new investors have for getting started. I've chosen options that make use of experienced traders and diversification to help ease you in to what can be a risky investment option if you try going it alone.

Getting started in the world of stock trading can be exciting and also daunting. In this post I'm going to break down some of the options new investors have for getting started. I've chosen options that make use of experienced traders and diversification to help ease you in to what can be a risky investment option if you try going it alone.

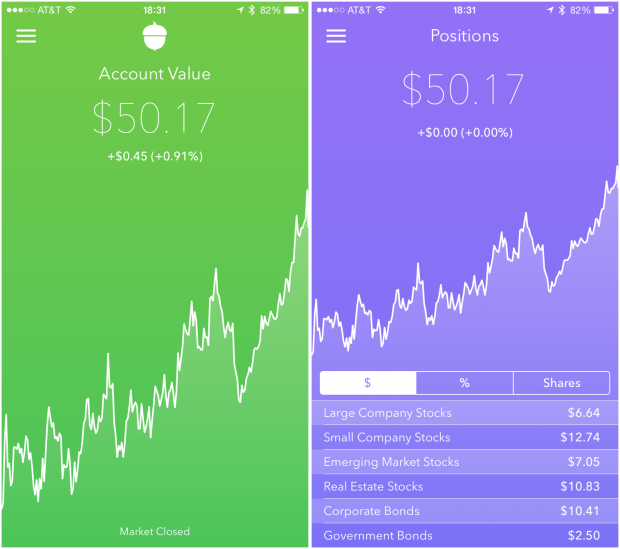

Acorns

Acorns is one of my favorite investment tools. It uses a concept known as dollar cost averaging – investing small amounts, at regular intervals. This way you profit from the overall growth the markets and don't have to worry about jumping in and buying at the right time.

Acorns invests your money in a broad range of ETFs. And the portfolios were put together with help from nobel prize winning economist Harry Markowitz.

What I love most about Acorns is that it lowers the barrier of entry for investing in stocks. You can get started investing with as little as $5. And Acorns will work in the background, investing small amounts of your spare change.

So if you're looking for an option to invest in stocks which is hands off and requires no expert knowledge or skills – then Acorns is a great pick for you.

ETFS

While you can automatically invest in ETFs through Acorns, unfortunately the app isn't available in all countries. So if you're based in a location where you don't have an app like Acorns available, you can still use some of the same investment ideas, by manually investing in ETFs.

Apps like Robinhood will let you buy stocks with zero fees. So you can buy and sell ETFs very cost effectively. So which ETFs should you buy? Look for ETFs that track the performance of an entire exchange or benchmark. History has shown that the stock markets have gained in value over the longer term. And by investing in ETFs that track this value, you're investments should gain in value too.

Dividends

Dividend investing is where you purchase stocks that pay dividends. Dividends are way for companies to distribute their profits to shareholders. Dividend investing is truly passive income as you'll earn a dividend just by holding onto the stock.

Not all stocks pay dividends, and I can't go into detail as to what makes a good dividend stock. So you'll need to do your research. Just beware – dividend investing requires a lot of capital to make a decent return. It could take decades to build up an income of dividends. So if you're willing to lock up a lot of your captial for long term returns, then this option might be for you.

Practice Trading Stocks

Here's an option that won't cost you a dime! Before trading stocks on your own, I would recommend starting with a practice trading account. Most online brokers offer practice accounts (sometimes also called virtual or demo accounts), that allow you to trade using virtual money under real trading conditions.

So there you have it! 5 different options of investing in stocks and one good way to ensure you don't lose any money at all 😉

Let me know in the comments how you got started in stock trading.