ETFs have gained in popularity over the past few years. And there is plenty of money to be made in investing in them. So in this post I'm going to give you some good options for investing and making money in ETFs no matter where you live in the world.

ETFs have gained in popularity over the past few years. And there is plenty of money to be made in investing in them. So in this post I'm going to give you some good options for investing and making money in ETFs no matter where you live in the world.

ETFs are basically a mutual fund that is traded just like a stock on an exchange. This means you can buy and sell ETFs as easily as you can buy and sell any stock.

All ETFs are different and put together with an underlying investment goal. Some are put together to track the indexes. Others are designed to go up if the price of the market goes down. Some are made up of commodities etc. It's important you don't just go and invest in any ETF with the expectation it will rise in value in the long term. This won't happen.

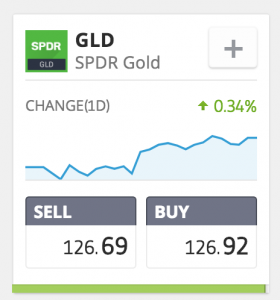

Tradings ETFs with your broker

If you're looking to trade ETFs with a broker, then I would recommend going with Robinhood. Why? because you won't be charged any fees. If you're starting with smaller amounts of capital this will make a huge difference to your profitability. Unfortunately Robinhood is only available in the U.S. Traditional brokers will charge around $10-$20 per trade. This means I would only trade if you have around $1k+ to trade with. Otherwise the fees will eat into your profits.

Investing in ETFs with as little as $5

If you're looking for a low cost way to get into ETFs then try Acorns. Acorns is a savings and investment app that transfers small amounts from your bank into an investment account. This money is invested into a broad range of ETFs. The portfolio has been put together by experts so you don't have to worry about picking the right ETF to invest in.

While you're never going to make a million dollars from Acorns, it's a great way to automate your savings and still get exposure to ETFs. You can find out more about Acorns and how it works here.