How Does eToro Make Money

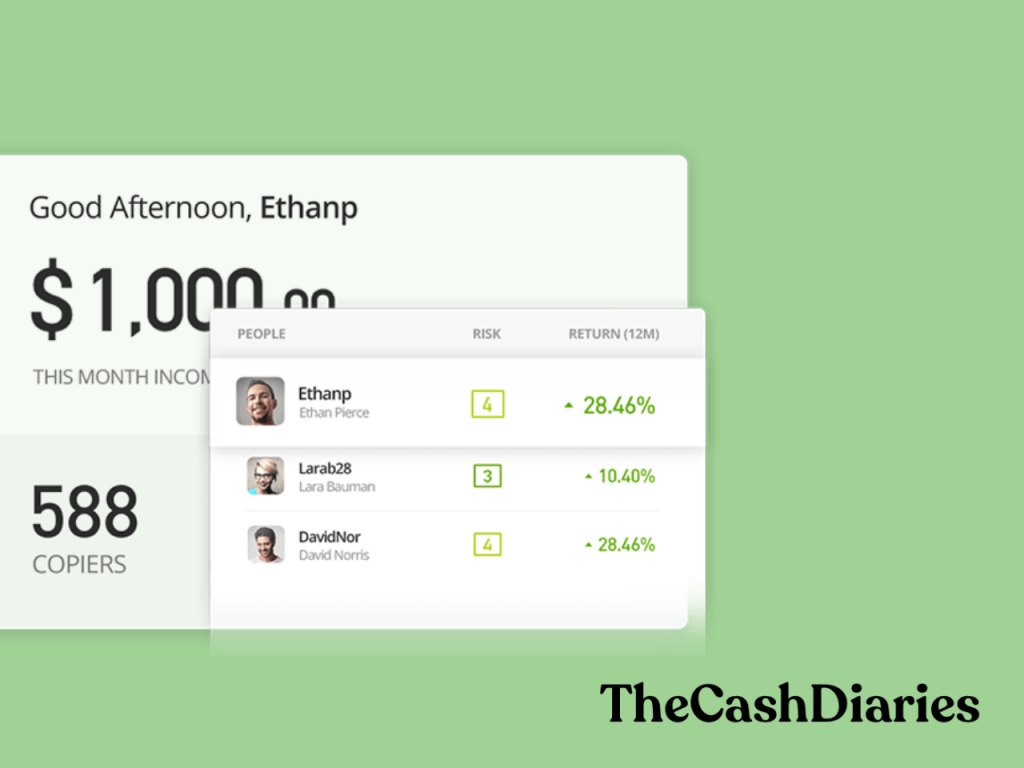

eToro is one of the worlds most popular copy trading platforms. Have you ever wondered how they make money? This is my guide on how eToro makes money: How eToro Makes Money eToro is a privately held company so we…

Legit Passive Income Ideas: 2023 Guide

The best way to grow your net worth is to increase your income. I know that sounds obvious but most people focus just on “saving money” instead “making money”. I’ve been working on building up my passive income to supplement…

How to Close a Trade on eToro

Investing in stocks and crypto through eToro is a little different to many other trading platforms. And opening and closing trades can sometimes be a little confusing. Here is how to close a trade on eToro: How to Close a…

The Best Alternative Investments for 2023

Are you looking to expand your portfolio beyond stocks? We’re lucky that in 2023 there are a wealth of alternative investments. Many of these investments don’t require a huge amount of capital and don’t require you to be a sophisticated…

Making Money on Medium

Did you know that you can make money by writing on the popular blogging platform Medium? Medium has a partner program that pays you when people read your content. If you’ve been looking to make money from your writing, then…

Making Money Investing in Art

Are you looking for alternative investments? Did you know that it’s possible to invest in high quality, “blue chip” art, even if you’re not a millionaire. In this post I’m going to be explaining how the unique Masterworks platform works…

Money Making Skills You Can Learn during Lockdown

Are you looking to make the most of your time during the Coronavirus Lockdown? Now is the perfect time to pick up some new skills. And what better skills to learn then ones that can help you make some more…

Here’s a Swagbucks Promo Code for 2020

Swagbucks is one of the best ways to make money from surveys and earn cashsback on your shopping. Using this Swagbucks promo code you can get $3 free just for signing up. While you won’t get rich for using…

How to trade stocks using Bitcoin and SimpleFX

Have you ever wanted to use your Bitcoin for more than just hodling? Have you ever wanted to buy and sell stocks using Bitcoin? Well now you can thanks to the SimpleFX trading platform. In this guide I’m going to…

The best No Deposit Forex Bonuses for 2020 💸

Here are my favorite forex No Deposit Bonuses for 2020. I’ve signed up to a bunch of different forex trading platforms, and these were the ones that actually worked and didn’t cause me any hassle. So if you’re looking to…